Apply for PAN - Income Tax Department

Applying for a Permanent Account Number (PAN) online in India is a straightforward process. You can choose from several authorized platforms to complete your application:

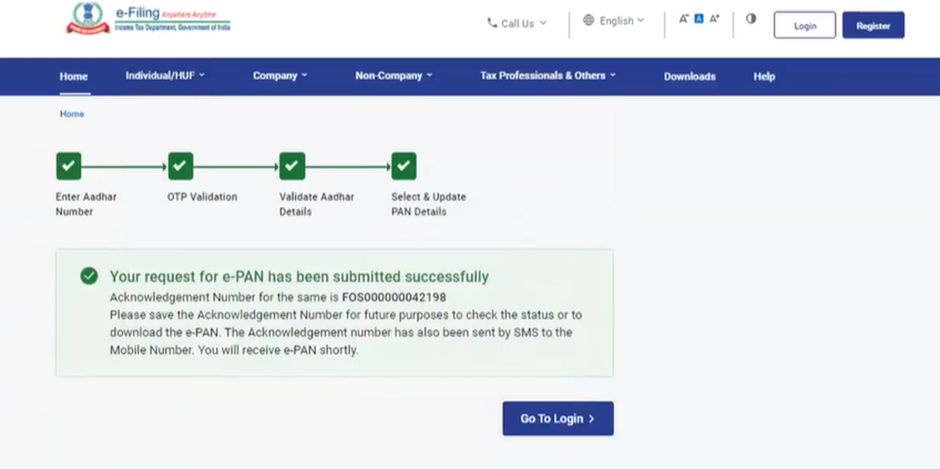

1. Instant e-PAN through the Income Tax Department:

If you have a valid Aadhaar number linked to your mobile number, you can obtain an e-PAN instantly:

- Visit the Income Tax e-Filing Portal: Navigate to the Instant e-PAN section.

- Apply for e-PAN: Click on 'Get New e-PAN' and follow the on-screen instructions, which include entering your Aadhaar number and verifying via OTP sent to your registered mobile number.

Online Apply Link

Check Pancard Status

- Download e-PAN: After successful verification, your e-PAN will be generated and can be downloaded in PDF format.

NoteThis service is free of cost and available only to individual Indian citizens.

2. PAN Application through Protean eGov Technologies Limited (formerly NSDL e-Gov):

You Can Apply PAN in 3 Ways in NSDL

1: By Visiting the Official Website of NSDL Pan Application

- Access the Online PAN Application: Go to the Protean eGov PAN Services.

- Select Application Type: Choose 'New PAN - Indian Citizen (Form 49A)' for new applications.

- Fill in the Form: Provide the required personal and contact details.

- Submit Documents: Upload scanned copies of identity proof, address proof, and date of birth proof.

- Payment: Pay the applicable fee online.

- Acknowledgment: After successful submission, an acknowledgment receipt will be generated.

NoteThe physical PAN card will be dispatched to your address within 15-20 days.

2: By Visiting the Nearest CSC Center or NSDL Pan Center (Aadhar Hard Copy, 2 Passport Size Photo,Applicant Sign)

- Go to the Nearest CSC Center or NSDL Facilite Center and fill the form Online

- After Filling the Online Form the CSC Operator Provide you a Form and Acknowledgement Slip

- Paste the 2 photos on the form and physically sign the form at required space

- After that the CSC Center will scan the document and complete the remaining process

- Applicant must ensure that all the details filled online or offline is correct and no error is thier

- Applicant can track their Pancard status through the offical site by using Acknowledgement No. printed on Acknowledgement Slip

NoteThe physical PAN card will be dispatched to your address within 15-20 days.

3: By Visiting the Nearest CSC Center or NSDL Pan Center (Aadhar Based eKYC)

- This Process is the Fastest One and Only Required Aadhar Card

- Go to the Nearest CSC Center or NSDL Facilite Center and fill the form Online

- Authentication is required either you have a mobile number linked to your aadhar card

- Applicant must ensure that all the details filled online or offline is correct and no error is thier

- Applicant can track their Pancard status through the offical site by using Acknowledgement No. printed on Acknowledgement Slip

NoteThe physical PAN card will be dispatched to your address within 15-20 days.

3. PAN Application through UTI Infrastructure Technology and Services Limited (UTIITSL):

Alternatively, you can apply via UTIITSL:

Visit the UTIITSL PAN Portal: Navigate to the UTIITSL PAN Services.

Choose Application Type: Select 'Apply for New PAN Card (Form 49A)'.

Complete the Form: Enter the necessary details and upload the required documents.

Make Payment: Pay the processing fee online.

Submission: Submit the form online.

Note: The PAN card will be sent to your provided address after processing.

Documents Required:

Proof of Identity: Aadhaar card, Voter ID, Passport, or Driving License.

Proof of Address: Aadhaar card, Passport, Driving License, or utility bills.

Proof of Date of Birth: Birth certificate, Matriculation certificate, Passport, or Driving License.

Ensure that the details provided are accurate to avoid any delays in processing.